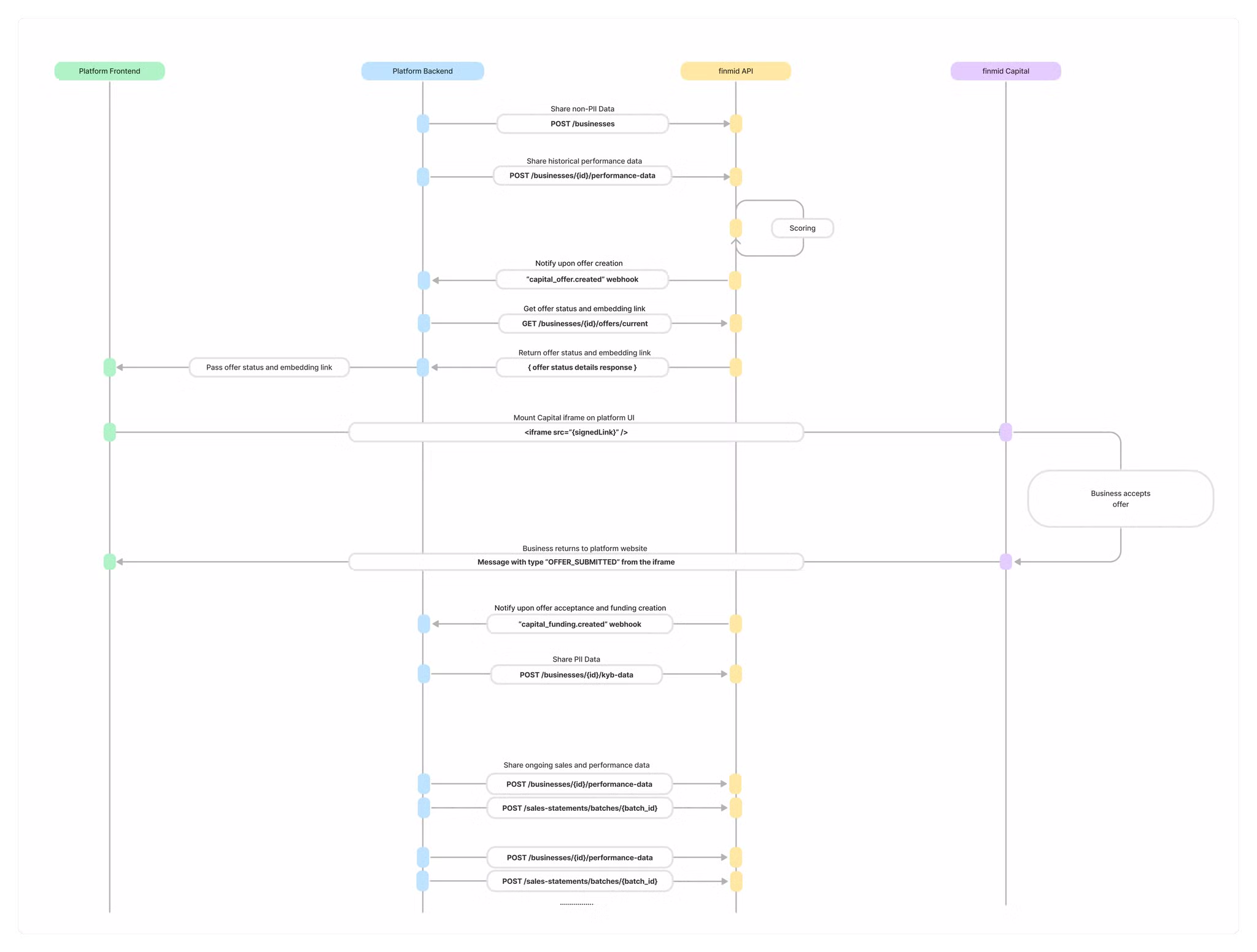

Overview of Capital integration

This integration consists of multiple components, including the Platform Frontend, Platform Backend, finmid API, and finmid Capital widget.

Here's a step-by-step summary of the process:

1. Data sharing and offer generation

Platform sends non-PI (Personally Identifiable) data and historical performance data to finmid API:

post Create Business (for non-PI data)

post Submit Business performance data (for historical data)

finmid API uses the received data to generate an offer by scoring the business.

2. Offer creation and embedding

After scoring, finmid API notifies the Platform Backend upon offer creation via a webhook (capital_offer.created).

Platform Backend retrieves the offer status and embedding link:

- GET /businesses/{id}/offers/current (retrieving offer details)

The Offer status and a signed link are then passed to the Platform Frontend, allowing the Platform to embed a Capital Offer frame using an iframe (dynamic UI):

<iframe src="{signedLink}" />

3. Business decision (acceptance or rejection)

A business accesses the offer through the Platform Frontend iframe integration and makes a decision:

If the business accepts the offer, this action is communicated back by iframe to the Platform Frontend with a message of type OFFER_SUBMITTED.

When Business grants finmid consent to collect its Personally Identifiable Information finmid notifies Platform via the kyb_data_consent.granted webhook.

Upon acceptance, finmid notifies the Platform Backend of the successful creation of funding via the webhook (capital_funding.created).

4. Post-acceptance data sharing

Once the data sharing consent is approved, PI data is shared between the Platform Backend and finmid API:

post Submit Business's KYB data

Additionally, ongoing performance and sales data is shared regularly via the following API endpoints:

post Submit Business performance data

post Add Sales statements to a batch

5. Platform shares funds with finmid

To compute payments, Platforms share payment information with finmid, and payments are processed through three options:

-

Sales statements flow - Platform-managed payments where the Platform sends Sales statements, and finmid calculates the payment amount and commission to be deducted:

-

Payment reporting flow - Platform-managed payments where the Platform reports already-collected payments to finmid in batches:

post Report Payment

-

Direct debit by finmid - finmid handles the payment collection directly from the Business's bank account.

Continuous performance on payments makes Businesses eligible for renewed Funding offers.

6. Business receives renewal Offers

After Business has paid at least 60% of the outstanding amount, shown good payment behaviour and maintain consistent sales performance, finmid automatically creates and shares renewal Offers.

Renewals often come with improved terms compared to the initial Funding, and enhances financial flexibility for Businesses.

Key Points

- The diagram captures the flow between multiple entities: Platform Frontend, Platform Backend, finmid API, and finmid Capital.

- The process revolves around data sharing, offer generation, embedding the offer UI, and subsequent business decisions.

- Webhooks play a crucial role in notifying the platform about critical events like offer creation and funding.

This is a high-level description of how the finmid Capital product integrates within the Platform ecosystem.

Each step in the process is designed to streamline communication between the Platform, the Business, and the finmid Capital service.

Updated 3 months ago